What’s Your Retirement Vision?

Wouldn’t it be disappointing to dream about a comfortable retirement and then find yourself unable to enjoy your leisure years because of limited financial resources? Unfortunately, this is a possibility for people who underestimate retirement expenses and the rising cost of living.

Wouldn’t it be disappointing to dream about a comfortable retirement and then find yourself unable to enjoy your leisure years because of limited financial resources? Unfortunately, this is a possibility for people who underestimate retirement expenses and the rising cost of living.

Evaluate Spending and Costs

Although your expenses may change when you retire, reductions in some areas (such as clothing and transportation to and from work) could be offset by higher costs in others. For example, your home energy expenses may be higher if you spend more time at home, and health-related costs typically increase as you grow older.1

Some expenses, such as food and housing, may stay about the same. Home-related expenses represent at least 42% of spending for Americans aged 50 and older, regardless of whether they are retired.2 One study found that even though three out of five workers expect to spend less in retirement, half of retirees said their spending in the early years of retirement was about the same or higher than it was when they were working.3

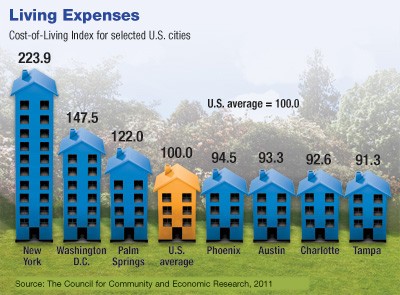

Where you live could play a significant role in your overall expenses. If you’re living on a limited income, your money might go further in some cities and states than it could in others (see the cost-of-living chart). You’ll need to consider not only the cost of housing, food, and utilities but also taxes. States have varying rules for taxing pension and Social Security income, and property and sales taxes may vary not only by state but by county.

Enjoy the Lifestyle You Want

Enjoy the Lifestyle You Want

As you calculate the savings it may take to retire, remember to factor in your retirementwants as well as your basic needs. What do you picture for your retirement? The top retirement dream for today’s older Americans is vacation and travel.4Perhaps you’d like to see South America or go fly fishing in Alaska. Maybe you want to work on your golf or tennis game, or enjoy a hobby that you don’t have time for now. You might like to volunteer for your favorite charity or move closer to your children and grandchildren.

Sixty-nine percent of middle-income Americans say they’d like to work in retirement in order to “stay busy.”5 While this could be a worthwhile goal, wouldn’t it be nice to work on your own terms — to pursue your passion instead of a paycheck?

If you’re young, retirement may seem too far off to worry much about. If you’re approaching the end of your working years, you may have a clearer picture of life after work. Regardless of your age, a solid financial strategy could help you retire more comfortably.

1–2) Employee Benefit Research Institute, 2012

3) Employee Benefit Research Institute, 2010

4) AARP, 2011

5) Journal of Financial Planning, August 2011

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. Copyright © 2012 Emerald Connect, Inc.