Big, Medium, and Small: Spreading the Risk

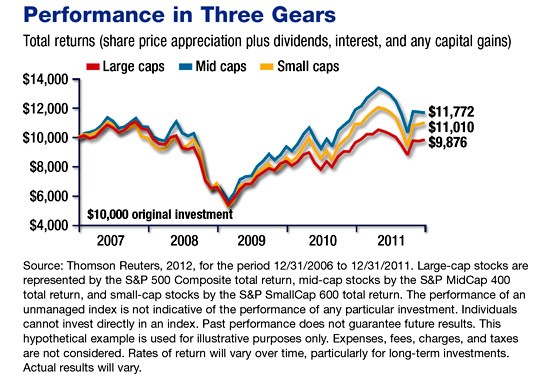

During the five-year period from 2007 to 2011, the total return of the S&P 500 index (representing large-cap stocks) was a disappointing –1.24%, which may not be surprising considering the impact of the Great Recession. On the other hand, the performance of small- and mid-sized company stocks during this period might surprise you: Total returns of the S&P MidCap 400 and S&P SmallCap 600 indexes were 17.72% and 10.10%, respectively (see graph). Of course, remember that past performance does not guarantee future results.

These three indexes track different types of stocks based on a company’smarket capitalization, the number of outstanding shares multiplied by the price per share. Understanding these classifications could help you diversify the stock component of your portfolio. Diversification does not guarantee against loss; it’s a widely used method to help manage investment risk.

One Size Doesn’t Fit All

The S&P 500 focuses on large-cap stocks with a market capitalization exceeding $4 billion.1 Stocks of these companies are generally considered more stable than those of smaller companies. But as the recent recession made clear, size does not insulate investors from market volatility. Although large-cap stocks may provide positive long-term returns, they typically have lower growth potential.

The S&P MidCap 400 tracks mid-sized companies with capitalizations of $1 billion to $4.4 billion.2 Mid caps may have greater growth potential than large caps, and mid-sized companies can sometimes react more nimbly to changes in the business environment. However, mid caps are associated with a greater risk of loss and volatility.

The S&P SmallCap 600 tracks companies with a market capitalization of $300 million to $1.4 billion.3 Small-cap stocks are typically the most risky and volatile of these three classifications, but they may offer the highest growth potential.

The performance of an unmanaged index is not indicative of the performance of any specific investment. Individuals cannot invest directly in an unmanaged index.

Diversifying with Mutual Funds

One way to diversify the equity portion of a portfolio is by investing in mutual funds that focus on stocks with different market capitalizations. Even though the terms “large cap,” “mid cap,” or “small cap” may appear in a fund’s name, it is important to research the underlying stocks to determine the fund’s objectives. The investment return and principal value of stocks and mutual funds fluctuate with market conditions. Shares, when sold, may be worth more or less than their original cost.

Diversification has the potential to help improve your portfolio’s performance over time. The key is to develop a diversification strategy that is appropriate for your personal situation, long-term goals, and risk tolerance.

Mutual funds are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

1–3) Standard & Poor’s, 2012

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. Copyright © 2012 Emerald Connect, Inc.