Investing When Rates Are Low

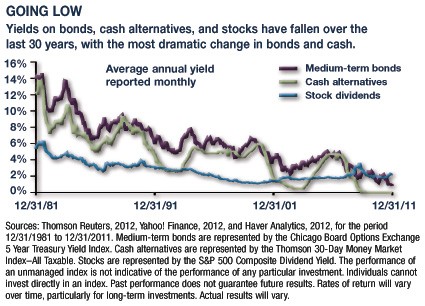

Interest rates have been exceptionally low for three years now — and are expected to remain so through the end of 2014, according to the Federal Reserve.1 Meanwhile, market volatility has been high. These are challenging times for risk-averse investors who want to improve their returns.

Interest rates have been exceptionally low for three years now — and are expected to remain so through the end of 2014, according to the Federal Reserve.1 Meanwhile, market volatility has been high. These are challenging times for risk-averse investors who want to improve their returns.

If you are retired or approaching retirement, capital preservation is important, but you also want your portfolio to outpace inflation in order for it to last throughout retirement. So how do you factor the prospect of continued low interest rates into your investment strategy?

Cushioning with Cash

In a low-interest-rate environment, savings accounts, bank money market accounts, CDs, and other cash alternatives offer low earnings potential. However, these generally stable vehicles may still play a role in helping mitigate the impact of market volatility in your portfolio. It’s also important to keep reserves in liquid accounts to handle unexpected as well as routine large expenses and to take advantage of future investing opportunities.

Bracing with Bonds

Like cash alternatives, bonds may play a key role in your portfolio regardless of low interest rates, but you should choose your investments based on the same sound criteria you would utilize if interest rates were higher. Bonds with longer maturities generally offer higher yields than short- and medium-term bonds.2 However, you may not want to commit to long-term bond investments in the current interest-rate environment because you might not be able to take advantage of more attractive yields when rates rise in the future.

Diving into Dividends

Diving into Dividends

Equities may offer the potential to outperform cash and bond investments, but they carry higher risks. If you have trepidations about investing in a volatile stock market, one approach is to focus on well-established companies that pay dividends.

Cash reserves held by U.S. corporations are currently near a 50-year high.3And some companies with excess cash are paying higher dividends. In 2011, companies included in the S&P 500 offered 388 dividend increases, compared with only 261 in 2010.4 The amount of a company’s dividend can fluctuate with its earnings, which are influenced by economic, market, and political events. There is no guarantee that a corporation will continue paying dividends in the future.

Although companies that pay dividends may not offer the growth potential of some newer companies that reinvest their profits, dividend-paying stocks may be less volatile. And if you have a longer-term time horizon, reinvesting any dividends can increase the potential for total return — share price appreciation or depreciation plus all investment earnings, including dividends and interest. Of course, as demand for dividend-paying stocks increases, their prices can become more expensive.

The return and principal value of stocks, bonds, and cash alternatives fluctuate with market conditions. Shares, when sold, and bonds redeemed prior to maturity may be worth more or less than their original cost. The FDIC insures bank CDs, savings accounts, and money market deposit accounts, which generally provide a fixed rate of return, up to $250,000 per depositor, per federally insured institution. Investments seeking the potential for higher yields also involve a higher degree of risk.

Even though a low-interest-rate environment can be challenging, there may still be opportunities for careful investors. Just be aware that if you’re searching for higher yields, you could take on more risk than may be appropriate for your situation.

1) Federal Reserve, 2012

2) Yahoo! Finance, 2012

3) Time.com, January 18, 2012

4) The Fiscal Times, February 10, 2012

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. Copyright © 2012 Emerald Connect, Inc.