Understanding Beneficiary Designations

A will is a good starting point to help ensure that your assets are passed on to your heirs according to your wishes. However, it’s also important to specify beneficiaries for financial accounts and insurance policies on the appropriate forms, which may supersede instructions in a will.

In any document distributing assets to your heirs, you may want to designate contingent beneficiaries in the event that a primary beneficiary predeceases you. If your spouse is still alive, a typical approach would be to leave the assets to your spouse, with your children as contingent beneficiaries. If your spouse has passed away, you might leave your estate in equal shares to your children.

This is fairly straightforward, but what happens in the unfortunate event that one of your children predeceases you? That would depend on the language of your will or beneficiary designation form. It may be helpful to understand two common Latin terms.

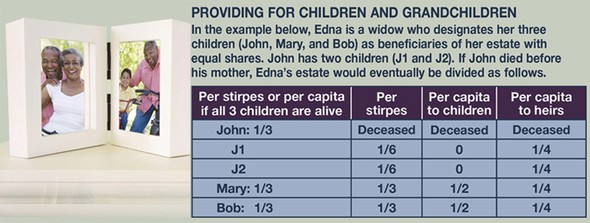

Per stirpes (also called “by representation”) literally means by the roots, but it might be clearer to imagine the branches of the family tree. If one of your beneficiaries predeceases you, his or her share would be divided proportionately among his or her heirs upon your death.

Per capita literally means by the head, indicating equal shares for each member of a group. If one of your beneficiaries predeceases you, the division of assets would depend on how you defined the group of heirs.

For example, if the beneficiary forms designate that assets go to yourchildren per capita and one child predeceases you, your assets would be divided among your surviving children, and any children of the deceased child would receive nothing. However, if you indicate that your assets should go to your heirs (or issue) per capita (or to your surviving children and children of any deceased child per capita), your assets would be divided equally among your surviving children and the children of your deceased child upon your death (see chart).

If you do not clearly specify your wishes, your assets could be distributed according to state law and/or the default method defined in your account or policy documents. Before making estate planning decisions, it would be wise to consult an experienced estate planning professional.

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. Copyright © 2013 Emerald Connect, Inc.