Understanding Your Social Security Options

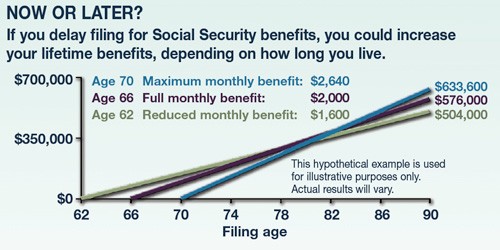

About half of retirees file for Social Security benefits when they first become eligible at age 62.1 The age to receive “full” Social Security benefits is 66 for workers born between 1943 and 1954.

If you were born in this period and file for benefits at age 62, you would typically receive 75% of your full benefit. If you wait until age 70 before filing, your maximum monthly benefit would be equal to 132% of your full benefit.2 Your decision on when to file for Social Security might be based on a combination of factors, including your health, life expectancy, work situation, retirement goals, and other sources of income.

If you are married, Social Security allows additional filing strategies that you and your spouse may want to consider. Here are two hypothetical examples shown for illustrative purposes only; individual results may vary. Both examples assume that the husband and wife have reached age 66 and are eligible for full retirement benefits.

Example 1. Bill is eligible for a $2,000 monthly benefit at age 66, but he wants to keep working until age 70 in order to receive his maximum benefit of $2,640 ($2,000 x 132%). Bill’s wife, Alice, is eligible for a monthly benefit of $600 based on her own earnings history. If Bill applies for benefits and requests to have his benefits suspended, Alice could receive a spousal benefit of $1,000 (equal to one-half of Bill’s full benefit amount).3

Example 1. Bill is eligible for a $2,000 monthly benefit at age 66, but he wants to keep working until age 70 in order to receive his maximum benefit of $2,640 ($2,000 x 132%). Bill’s wife, Alice, is eligible for a monthly benefit of $600 based on her own earnings history. If Bill applies for benefits and requests to have his benefits suspended, Alice could receive a spousal benefit of $1,000 (equal to one-half of Bill’s full benefit amount).3

Example 2. John and Mary are eligible for benefits of $2,000 and $1,600, respectively. If they both claim full benefits at age 66, they could receive a total of $1,036,800 over the next 24 years. Alternatively, Mary could claim her benefit and John could claim a spousal benefit of $800 (one-half of Mary’s $1,600 benefit amount); then at age 70 John could switch to his own maximum benefit of $2,640 based on his own work record. This strategy would yield the couple a total of $1,132,800 over 24 years, an additional $96,000.4

Social Security regulations are complex, so it might be wise to seek professional guidance before taking any specific action.

1) smartmoney.com, March 2, 2012

2–4) Social Security Administration, 2012

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. Copyright © 2012 Emerald Connect, Inc.