To Convert or Not to Convert? That’s the Roth Question

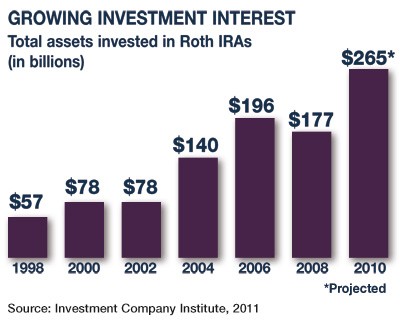

Nearly 20 million U.S. households have a Roth IRA — a significant number considering that it has been around only since 1998. However, Roth IRA participation still lags behind that of traditional IRAs, which were first introduced in 1974.1

Nearly 20 million U.S. households have a Roth IRA — a significant number considering that it has been around only since 1998. However, Roth IRA participation still lags behind that of traditional IRAs, which were first introduced in 1974.1

The good news is that you can invest in more than one type of IRA (the combined contribution limit in 2012 is $5,000, or $6,000 for those aged 50 and older). And regardless of your income, you can convert all or part of your traditional IRA investments to a Roth IRA and benefit from tax-free withdrawals in retirement.

Paying Taxes Now or Later

Contributions to a Roth IRA are made with after-tax dollars (subject to income limits), whereas contributions to a traditional IRA are generally tax deductible. When you withdraw money, however, qualified distributions from a Roth IRA are free of federal income tax if you’ve satisfied the requirements (distributions may be subject to state income taxes). By contrast, traditional IRA withdrawals are taxed as ordinary income.

When you convert tax-deferred IRA assets to a Roth IRA, the conversion amount is taxed as ordinary income in the tax year of the conversion. This can be a significant expense, but there’s a trade-off: Under current tax law (and if all conditions are met), the Roth account will incur no further income tax liability for the rest of your lifetime or for the lifetimes of your account beneficiaries, regardless of how much growth the account experiences.

Here are some considerations to help determine whether a Roth IRA conversion might be appropriate for you.

Changing tax brackets. The logic behind deferring taxes on retirement savings is that investors may be in a lower tax bracket in retirement than they were during their working years. This is not always the case, of course, so you need to consider your own situation. Also keep in mind that tax rates are scheduled to increase after 2012 (unless Congress takes further action), so you may pay higher tax rates in the future.

Mandatory distributions.Unlike the case with traditional IRAs, there are no required minimum distributions (RMDs) at age 70½ for original Roth IRA owners, so you can keep money in your account until you need it, or bequeath it to your heirs if you wish (IRA beneficiaries must take RMDs). The longer your investments can pursue growth, the more advantageous it might be for you and your beneficiaries to have tax-free withdrawals.

Mandatory distributions.Unlike the case with traditional IRAs, there are no required minimum distributions (RMDs) at age 70½ for original Roth IRA owners, so you can keep money in your account until you need it, or bequeath it to your heirs if you wish (IRA beneficiaries must take RMDs). The longer your investments can pursue growth, the more advantageous it might be for you and your beneficiaries to have tax-free withdrawals.

Current value versus growth potential. If your tax-deferred assets have fallen in value over the last few years, one silver lining is that taxes on a conversion may be lower. Again, your choice on converting may depend on how much time your portfolio will have to pursue growth.

Keep in mind that you can convert as much or as little of your traditional IRA assets as you wish, and you can even spread the conversion process over a number of years to help manage the tax liability.

Traditional and Roth IRA withdrawals prior to age 59½ may be subject to a 10% federal income tax penalty. To qualify for a tax-free and penalty-free withdrawal of earnings, a Roth IRA must meet the five-year holding requirement and the distribution must take place after age 59½ or result from the owner’s death, disability, or a first-time home purchase ($10,000 lifetime maximum).

A Roth IRA conversion may not be an appropriate strategy for everyone, but it’s worth considering depending on your personal situation, time frame, and current and future tax brackets.

1) Investment Company Institute, 2011

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. Copyright © 2012 Emerald Connect, Inc.