Taming Taxes

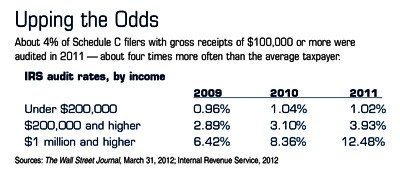

Small-business owners and independent contractors may be more likely than other taxpayers to benefit from the home-office tax deduction, which has an average value of more than $2,600.1 But some taxpayers may be hesitant to claim this potential tax benefit on their personal tax returns, fearing that it could trigger an IRS audit.

Their worries are not entirely unfounded. Taxpayers who claim home offices often don’t meet the requirements, or they calculate the deductible amount incorrectly. This checkered past may explain why the government tends to take a closer look at returns that include this deduction.

Even so, business owners who operate out of a home office and are legitimately entitled to claim the deduction should consider taking advantage of this valuable tax break.

Calculating the Benefit

Eligible taxpayers can write off a percentage of home expenses such as depreciation, rent, property taxes, insurance, utilities, maintenance, and repairs. The percentage is based on the square footage of the office space relative to the total size of the home.

Passing the Test

To qualify for a write-off, a home office must be used in a trade or business activity — not to manage personal investments or pursue a hobby. It must also be used regularly and exclusively for business. If part of your home is used to provide day care or to store products, you may not have to meet the exclusivity test. In addition, your office must meet at least one of the following three criteria:

To qualify for a write-off, a home office must be used in a trade or business activity — not to manage personal investments or pursue a hobby. It must also be used regularly and exclusively for business. If part of your home is used to provide day care or to store products, you may not have to meet the exclusivity test. In addition, your office must meet at least one of the following three criteria:

- It is the place where you normally meet with patients, clients, or customers.

- It is your principal place of business, meaning there is no other fixed location where you work on a regular basis.

- It is a separate structure that is used exclusively for trade or business. If the office space is not attached to the dwelling, it does not have to be the principal place of business.

If you take the deduction, make sure to keep good records, including pictures that show how your home office is used. You may want to ask a tax professional to help determine your eligibility and evaluate whether the potential tax savings may be worth the added IRS scrutiny.

1) businessweek.com, February 21, 2012

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. Copyright © 2012 Emerald Connect, Inc.