Surprise! It’s Retirement Time

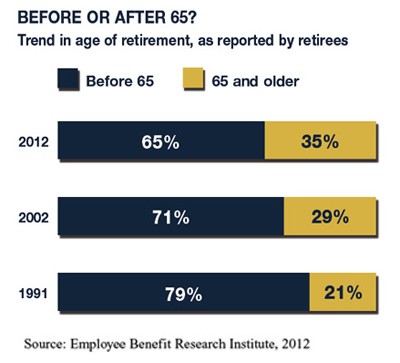

In a 2012 survey, 50% of current retirees said they retired earlier than they had planned, up from 45% in 2011.1

In a 2012 survey, 50% of current retirees said they retired earlier than they had planned, up from 45% in 2011.1

Many retirees reported reasons that were beyond their control, such as health problems or disability, company downsizing or closure, changes in the skills required for their jobs, or having to care for a spouse or family member. Yet some said they retired early by choice — because they could afford to or because they wanted to do something different.2

If you’re nearing the end of your working years, you probably have a retirement timetable in mind. It may be as specific as a particular date or as general as a range of years. Regardless of your timetable, circumstances could change — as the experience of current retirees demonstrates — and retirement might come sooner than you think.

Addressing some key issues now might ease your transition and give you more choices in how you retire.

Calculate Your Income Stream

If you had to retire early, would you be able to maintain your standard of living? It might be helpful to calculate your projected income based on your preferred retirement timetable and an earlier date.

Of course, the sooner you retire, the less time there will be for your investments to pursue potential growth, so accelerating your savings now could make a big difference in how much you might accumulate. If you retire on schedule (or later), having a potentially larger savings balance could give you more flexibility in your retirement lifestyle.

Also keep in mind that Social Security benefits typically will be reduced if you retire before your “full retirement age,” which ranges from 65 to 67, depending on year of birth.

Reduce Your Debt

Eliminating or reducing outstanding credit-card balances as soon as possible could be a great step toward getting on track for retirement. Paying off auto loans could also free up more income.

Although retirement strategies in the past were typically based on the assumption that retirees would have no mortgage debt, that has changed. About a third of homeowners aged 65 and older still have mortgages.3 If you foresee your mortgage being an issue in your retirement years, you may want to examine options to pay it off early, reduce payments, or otherwise modify the terms.

Consider Your Health

Your health and the health of your spouse could be among the most important factors in determining when you will retire. Ask yourself the following questions:

- Is your retirement timetable realistic based on your current health status?

- Would you be prepared if your health were to change?

- Have you factored the full cost of health care into your retirement strategy?

A married couple who retired in 2011 (with median expenses for prescription drugs) would need an estimated $287,000 to have a 90% chance of paying their health-care costs throughout retirement. Costs for future retirees may be much higher.4

Surprises can be fun in many situations, but not when it comes to retirement. Preparing now could help ease you into a more comfortable retirement lifestyle.

1–2) Employee Benefit Research Institute, 2012

3) U.S. Census Bureau, 2012

4) Employee Benefit Research Institute, 2011

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. Copyright © 2012 Emerald Connect, Inc.