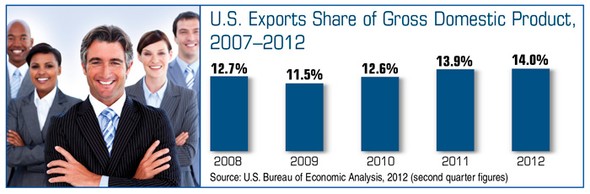

Adding Exports to Growth Strategies

The share of overall U.S. exports for companies with fewer than 500 employees rose steadily from 27% in 2002 to 34% in 2010. The number of small and midsize enterprises that export also reached a record high of 293,000, and roughly 70% of all exporting companies have 20 or fewer employees.1–2

A relatively weak dollar has supported U.S. exporters of all sizes in recent years, but U.S. goods and services could become more expensive if the dollar strengthens.3 Adding foreign sales to their ledgers may help insulate some U.S. small businesses from domestic economic downturns.

Expanding Markets

Despite a recent global slowdown, many of the world’s developing economies are still growing at a rate of 7% or more on an annual basis, whereas U.S. annual growth has remained below 3% since the recession.4As a result, large numbers of new consumers in China, Russia, India, Brazil, and elsewhere may provide potentially lucrative markets for the product offerings of smaller U.S. companies.

Some businesses don’t have to go far to find a new customer base; about 33% of all U.S. exports are shipped over a shared border to Canada or Mexico. Recent trade pacts may ease access into new markets such as South Korea, Colombia, and Panama.5

Filling Financing Gaps

Due to perceived credit risks, many banks won’t finance foreign trade for small and midsize companies. Fortunately, a federal agency called the Export-Import Bank of the United States (Ex-Im Bank) provides financing methods, including working capital guarantees, export-credit insurance, and loans to help foreigners buy U.S. goods and services. In fiscal year 2011, the bank authorized $32.7 billion in financing. About 87% of the bank’s transactions and 20% of financing dollars funded the exporting activities of small businesses.6–7

Where to Start

U.S. businesses can research specific foreign markets or learn about exporting in general at a new government website (exports.gov). In addition, the U.S. Small Business Administration operates walk-in Export Assistance Centers around the nation. New e-commerce sites have helped make the process easier for some exporters, and there are also private consultants who can assist with foreign currency and communication issues.8

Conducting business in an unfamiliar regulatory environment can be tricky, and it often takes several years to become export-ready. A strategy that includes exports is certainly not appropriate for every company.

1) U.S. Department of Commerce, 2012

2–4) Bloomberg Businessweek, December 9, 2011

5) U.S. Census Bureau, 2012

6) Export-Import Bank of the United States, 2012

7) Bloomberg Businessweek, March 26, 2012

8) USA Today, February 5, 2012

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. Copyright © 2013 Emerald Connect, Inc.