Cost of Early Retirement Plan Withdrawal

It’s not a good sign when people raid their retirement plans to pay bills, college tuition, or auto repairs, but more workers have been borrowing from their accounts or taking hardship withdrawals in the past few years. At the end of 2010, 28% of active 401(k) participants had outstanding account loans, and another 7% took early withdrawals.1 In 2011, retirement savings account loans rose by 20% across all demographics.2

Although it’s understandable that people might turn to their retirement accounts for a source of ready cash, it is generally not a good idea. Fifty-five percent of employees who took a cash distribution when changing jobs said they regretted having done it.3

Keep Your Money Working

With certain exceptions (explained later), a 10% federal income tax penalty applies to early withdrawals (before age 59½) from tax-deferred plans such as IRAs and employer-sponsored retirement plans. That’s a significant deterrent in itself, but the greater penalty could be the loss of future earnings needed for retirement.

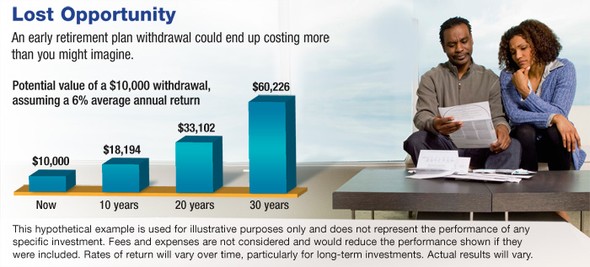

Consider the impact of a $10,000 early withdrawal from a traditional IRA. Not only could the distribution be subject to the penalty ($1,000) but also income taxes ($2,800 for someone in the 28% tax bracket), which could leave a net amount of $6,200. On the other hand, if the $10,000 principal was left in the tax-deferred account, in 20 years it would have the potential to more than triple, assuming a 6% average annual return; in 30 years, it might reach $60,000 (see graph). This hypothetical example is used for illustrative purposes only and does not reflect the performance of any specific investment; actual results will vary.

If you change jobs, you may be able to leave your retirement account assets in your former employer’s plan. Another option is to roll the assets to a traditional IRA. A properly executed trustee-to-trustee transfer to your own IRA could help preserve the tax-deferred status of the funds and potentially avoid unwanted current tax consequences and penalties. It may also give you more control of the assets, open up additional investment options, and help you manage overhead costs.

Exceptions to the Penalty

If life deals you a bad hand, or you have other reasons to access your retirement funds earlier than planned, there are circumstances in which the penalty is waived on early withdrawals before age 59½ (although distributions would still be subject to ordinary income tax):

- Your death or permanent disability.

- A series of substantially equal periodic payments (based on life expectancy) from an IRA or a former employer’s plan that continue for at least five years or until age 59½, whichever occurs later.

- Payment of unreimbursed medical expenses that exceed 10% of adjusted gross income (in 2013).

- Employer plans only: If you are at least age 55 when you terminate or sever employment (or turn 55 by December 31 of the same year), all distributions avoid the penalty.

- IRAs only: The penalty is waived when the funds are used for qualified higher-education expenses or a first-time home purchase ($10,000 lifetime maximum).

If you take an early withdrawal from a tax-advantaged retirement account, you could lose the opportunity for that money to continue growing on a tax-deferred basis. This might lead to falling short of your retirement income needs.

1) Reuters, February 17, 2012

2) advisorone.com, January 17, 2012

3) advisorone.com, January 26, 2012

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. Copyright © 2013 Emerald Connect, Inc.