Family Limited Partnerships

The IRS calculates the estate tax due on your gross taxable estate by adding the value of your assets, including your home and/or business, and subtracting any applicable exemptions. Through 2012, the top federal estate tax rate is 35% with a $5.12 million exemption amount. However, in 2013, the top estate tax rate is scheduled to increase to 55% with a much lower $1 million exemption, unless Congress acts to amend or extend the tax law.

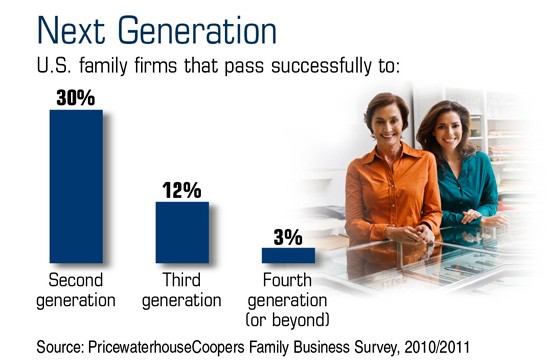

Many business owners may simply fail to consider the possibility that estate taxes could be due upon their passing. But if the money needed to pay the bill is not otherwise available, heirs may have no choice but to liquidate the family’s business. Starting the succession planning process sooner rather than later could help mitigate estate tax exposure and potentially reduce family strife.

Business owners who want family members to inherit their businesses in the future could potentially use a family limited partnership (FLP) to transfer assets out of their estates during their lifetimes. Moreover, they can often begin using this technique many years before they intend to give up control of the operations.

Family Discount

If a family limited partnership is set up for the benefit of limited partners such as a spouse and children, a general partner (or a corporation or limited liability company controlled by the general partner) may gift ownership shares in installments that conform to the $13,000 annual gift tax exclusion (in 2012).

Gifts of limited partnership interests can also be discounted up to 30% or more from fair market value, which may provide an opportunity to take even greater advantage of tax-free gifts. For example, a limited partner may be able to gift approximately $18,500 worth of property or business shares that are currently valued at $13,000 for gift-tax purposes.1 Each situation is different; actual results will vary.

Setting up a family limited partnership can involve complex tax rules and regulations. Be sure to consult with your tax advisor and an experienced estate planning professional.

1) 2012 Field Guide, National Underwriter

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. Copyright © 2012 Emerald Connect, Inc.