Growing Interest in ETFs

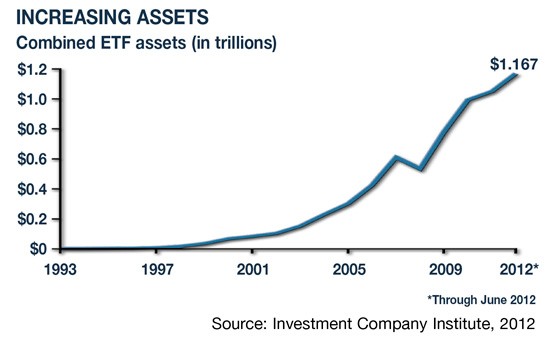

The first exchange-traded fund (ETF) in the United States debuted in 1993 as an alternative to mutual funds. Interest in ETFs grew slowly at first but increased substantially over the last decade. By May 2012, there were more than 1,200 ETFs available with total assets exceeding $1.1 trillion.1

Even so, ETFs remain somewhat mysterious to many people. In a survey of investors with at least $25,000 in investable assets and some familiarity with ETFs, 46% of respondents considered themselves ETF “novices,” and 25% indicated they did not understand the costs associated with ETFs or how to use them appropriately in their investment strategies.2

Part Mutual Fund, Part Stock

Like mutual funds, ETFs comprise a portfolio of securities assembled by an investment company. Unlike mutual funds, which are typically purchased from and sold back to the investment company and priced at the end of the trading day, ETF shares are traded throughout the day on stock exchanges at prices determined by the market. Investors can buy and sell ETF shares through a brokerage account just as they could with the shares of any publicly traded company. Supply and demand could make the share price of an ETF higher or lower than the value of the underlying securities.

Most ETFs are passively managed and track an index of securities. Investors can choose from a wide variety of indexes, including different categories of stocks, bonds, commodities, and other market sectors. Recently, a small but growing number of actively managed ETFs have become available in which the investment company assembles a unique mix of investments to meet a particular objective and policy.

Because of their trading flexibility and the variety of investment options, ETFs could play a helpful role in diversifying your portfolio to reflect your risk tolerance and long-term goals. Diversification is a method used to help manage investment risk; it does not guarantee against loss.

Exchange-traded funds typically carry lower expense ratios than mutual funds and may be more tax efficient. However, purchasing ETF shares generally involves a brokerage commission that can add significantly to the expense, especially if you trade often. The trading flexibility of ETFs may lead some investors to trade them more often than they would other securities, which could alter an otherwise sound investment strategy.

The principal value of ETFs and mutual funds will fluctuate with changes in market conditions. Shares, when sold, may be worth more or less than their original cost.

By combining some attributes of stocks and mutual funds, ETFs may offer an appealing investment opportunity. However, they may not be appropriate for everyone. A decision to include them in your portfolio should be based on an examination of your overall investment strategy.

Exchange-traded funds and mutual funds are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

1) Investment Company Institute, 2012

2) Business Wire, September 22, 2011

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. Copyright © 2012 Emerald Connect, Inc.