Hanging the “Help Wanted” Sign

Toward the end of 2011, an index that measures the hiring intentions of small businesses rose to its highest level in three years, and another report estimated that small businesses have added about 1.2 million new jobs since October 2009.1–2 All told, businesses with fewer than 500 employees have created about 65% of new jobs in the United States over the last 20 years.3

Toward the end of 2011, an index that measures the hiring intentions of small businesses rose to its highest level in three years, and another report estimated that small businesses have added about 1.2 million new jobs since October 2009.1–2 All told, businesses with fewer than 500 employees have created about 65% of new jobs in the United States over the last 20 years.3

Business owners may need to invest a fair amount of time and money to build a good team. Adding a salary can be substantial by itself. However, you must also consider the potential costs and responsibilities beyond wages when you are ready to hire new staff members.

Begin with the Big 4

Benefits. Employers that provide benefits such as health and dental plans, disability coverage, and life insurance may need to factor in costs ranging from 1.25 to 1.4 times the base salary. For example, an employee who earns $35,000 annually may actually cost the employer $44,000 to $49,000. You may also need to increase the budget for perks provided to existing employees — from free coffee to holiday parties and bonuses.4

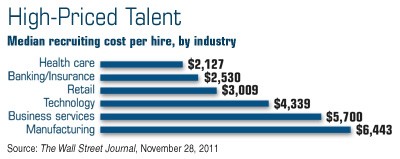

Recruiting. It’s not always easy to find the right fit for a new position. There are potential expenses associated with recruiting, including advertising, drug screenings, background checks, as well as the cost for someone to review resumes, screen applicants, and conduct interviews.

Training.Getting new employees up to speed and making sure they become as productive as possible can also be expensive. Employees spend an average of 32 hours a year on training, and new hires often need additional time to learn the ropes. One report estimated that companies spend about $1,200 annually per employee on training.5

Training.Getting new employees up to speed and making sure they become as productive as possible can also be expensive. Employees spend an average of 32 hours a year on training, and new hires often need additional time to learn the ropes. One report estimated that companies spend about $1,200 annually per employee on training.5

Compliance. Employers must often deal with a complicated array of federal and state regulations. Research may be needed to understand the possible cost of implementing requirements that apply specifically to your area and/or industry.

It’s exciting to discover an opportunity to expand the size or scope of your business, and sometimes extra help is needed to make that happen. Fortunately, successful small businesses are likely to continue providing employment opportunities in the years to come.

1) Businessweek, December 13, 2011

2) The Wall Street Journal, November 30, 2011

3) Associated Press, December 14, 2011

4–5) Yahoo! Finance, July 25, 2011

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. Copyright © 2012 Emerald Connect, Inc.