Making Your Own Retirement Opportunities

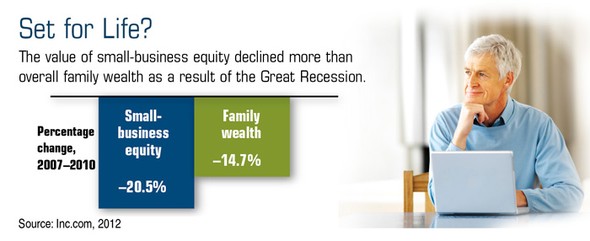

About two-thirds of small-business owners fear that they are financially unprepared for retirement, yet one-third of small-business owners do not have any type of personal or business-sponsored retirement plan in place.1–2

If you are worried about your retirement prospects, it may be well worth the effort to divert a percentage of your earnings into a tax-deferred retirement account on a monthly or annual basis.

Both of the following types of plans — individual (solo) 401(k) plans and SEP IRAs — are relatively simple and inexpensive for small-business owners (with no employees) and self-employed individuals to set up.

Solo 401(k)

You can make tax-deductible (or pre-tax) contributions to an individual 401(k) in two ways. As the employee, you can contribute as much as 100% of your annual compensation, up to the $17,500 annual maximum in 2013 ($23,000 if you are age 50 or older). As the employer, you can also contribute an additional 20% of your earnings (25% if the business is incorporated) and deduct it as a business expense. Total contributions are capped at $51,000 in 2013 (or $56,500 for those aged 50 and older).

SEP IRA

As a small-business owner or as a self-employed individual, you can make tax-deductible contributions to an IRA opened in your name. In 2013, you may be able to contribute as much as 20% of your net earnings, up to the $51,000 annual maximum. These contributions are generally tax deductible as a business expense.

Distributions from 401(k) plans and SEP IRAs are taxed as ordinary income. Early withdrawals (prior to age 59½) may be subject to a 10% federal income tax penalty. Annual required minimum distributions must begin for the year in which the participant turns 70½; the latest date to take the first distribution is April 1 of the year after the year in which the account owner turns 70½.

IRAs and 401(k) plans have exceptions to avoid the 10% early-withdrawal penalty, including death and disability.

Like most business owners, you may be focusing your time and energy on building a fruitful enterprise. However, the sooner you set up a retirement plan, the sooner your savings can begin accumulating on a tax-deferred basis.

1) CNBC.com, August 22, 2012

2) USA Today, March 1, 2012

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. Copyright © 2013 Emerald Connect, Inc.