Setting the Stage for Retirement Income

In a 2012 survey, 73% of annuity owners said annuity investments are a critical part of their retirement funding strategies, and 63% said market volatility makes them more likely to consider buying an annuity.¹

When saving for retirement, some workers who are concerned about stock market volatility may turn to fixed-income investments, but the current yields on these vehicles may not generate the income they will need.

For this reason, a variable annuity has become a popular option for pre-retirees and risk-averse investors. Using this hybrid insurance/investment product, they can set aside additional funds for retirement, defer taxes on earnings (until withdrawn), and potentially mitigate investment risk.

Investment Component

A variable annuity is an insurance-based contract that offers potential growth through market participation. The contract owner makes one or more payments to an insurance company during the accumulation phase in exchange for a regular income stream during the payout phase. These payouts could last for the rest of the owner’s lifetime (and/or the lifetimes of designated individuals), offering some protection from outliving assets.

The contract owner can invest the premiums among a variety of investment options, or “subaccounts,” according to his or her risk tolerance, long-term goals, and time horizon. Most contracts offer a range of stock, balanced, bond, and money market subaccounts, as well as a fixed account that pays a fixed rate of interest. The future value of the annuity and the amount of income available during retirement are determined by the performance of these selected subaccounts.

Because variable annuity sub-accounts fluctuate with changes in market conditions, the principal may be worth more or less than the original amount invested when the annuity is surrendered or annuitized. The investment return and principal value of an investment option are not guaranteed.

Insurance Features

Not only does a variable annuity offer a way to help pursue investment gains, but the contract owner may be able to purchase guarantees to help protect against the downside risks of investing in the markets. Optional benefits — such as a guaranteed minimum death benefit, a guarantee of minimum fixed income payments, or withdrawals of a specific amount over a lifetime, regardless of account value — may be available for an additional cost. Any annuity guarantees are contingent on the claims-paying ability of the issuing insurance company.

Variable annuities are not guaranteed by the FDIC or any other government agency; they are not deposits of, nor are they guaranteed or endorsed by, any bank or savings association.

Taxes Can Wait

Annuities purchased with after-tax dollars could help supplement other sources of retirement income. Only the earnings portion of variable annuity withdrawals is taxed as ordinary income. Withdrawals made prior to age 59½ may be subject to a 10% federal income tax penalty and could reduce the death benefit and value.

There are contract limitations, fees, and charges associated with variable annuities, which can include mortality and expense risk charges, sales and surrender charges, investment management fees, administrative fees, and charges for optional benefits.

Variable annuities are long-term investment vehicles designed for retirement purposes. They are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the variable annuity contract and the underlying investment options, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

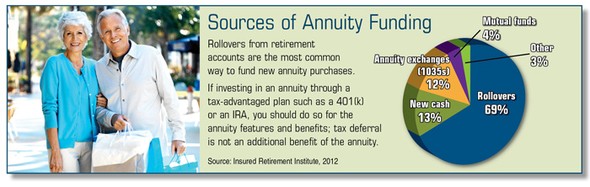

1) Insured Retirement Institute, 2012

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. Copyright © 2013 Emerald Connect, Inc.