The Risk of a “Flight to Safety”

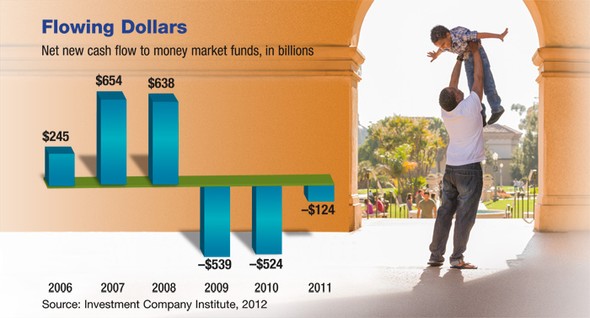

As the financial crisis grew in severity from 2006 to 2008, U.S. investors moved more than $1.5 trillion into money market mutual funds as a “flight to safety.” Over the next two years, cash flowed out of these funds almost as quickly as it flowed in when investors rushed to purchase growth-oriented securities in the recovering stock market (see chart).

This pattern reflects a natural reaction to market volatility. But it may not be the wisest course of action.

Stability Versus Growth

Money market funds are mutual funds that invest in cash-alternative assets, usually short-term debt. They seek to preserve a value of $1 per share, which is why they may be appealing when investors fear potential loss. However, money market funds typically offer low yields that have dropped to near zero in the current interest-rate environment.1

Because of this low growth potential, shifting a large percentage of assets into money market funds to help avoid the risks associated with market volatility may result in a different kind of risk: the risk that your investments might not keep pace with inflation and could miss out on an opportunity to grow.

Consider the recent recession. On March 5, 2007, the S&P 500 — a broad measure of the U.S. stock market — stood at 1,374.12. Two years later on March 5, 2009, the index hit its lowest point during the recession when it closed at 682.55. On March 5, 2012, three years after the low point, the index was at 1,364.33 and trending upward.2

Investors who stayed the course throughout this five-year period could have weathered the economic crisis and been poised to take advantage of any potential future market gains. By contrast, investors who sold assets when the market was near its low point may have experienced losses; and then by shifting those proceeds into money market funds, these investors might have missed out on potential growth when the market rebounded.

The performance of an unmanaged index is not indicative of the performance of any specific security. Individuals cannot invest directly in an index. Past performance is no guarantee of future results. Actual results will vary.

A Useful Financial Tool

Money market funds could help you create a portfolio that is appropriately allocated based on your risk tolerance and needs. In addition, you might use money market funds on a temporary basis to hold proceeds from the sale of assets until you are ready to reinvest. Money markets also provide a place to hold emergency savings.

Although money market funds could play a helpful role in your financial strategy, it’s important to understand their limitations.

Money market funds are neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although money market funds seek to preserve the value of your investment at $1 per share, it is possible to lose money by investing in such a fund.

Mutual funds are sold only by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

1) Investment Company Institute, 2012

2) Yahoo! Finance, 2012 (S&P 500 for the period 3/2/2007 to 3/2/2012)

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. Copyright © 2013 Emerald Connect, Inc.