Small Firms Still Face Credit Challenges

Many small firms have found it more difficult to borrow money since the financial crisis hit, and business access to credit has yet to improve despite an economic recovery. A larger percentage of small-business owners who applied for financing were unsuccessful in 2011 (44%) than in 2010 (34%), primarily because there was more demand for credit.1

Business owners often rely on credit to run their operations or to finance expansion. Unfortunately, the inability to obtain sufficient financing when needed is one reason that some businesses fail. Here are some pros and cons of several common types of financing that small businesses may use to raise cash.

Business owners often rely on credit to run their operations or to finance expansion. Unfortunately, the inability to obtain sufficient financing when needed is one reason that some businesses fail. Here are some pros and cons of several common types of financing that small businesses may use to raise cash.

Home equity. Many owners have relied on home-equity borrowing to finance the growth and development of their businesses. But lower property values and tighter lending standards mean that cash-out refinances and equity lines are less likely to be a viable option.2

Bank loans. Many financial institutions restrict lending to the most creditworthy businesses, and even qualified owners may need to contact many banks before finding one willing to offer financing. Banks often require significant collateral and several years of stable profits. New or fast-growing small businesses — even healthy ones with good prospects — are often rejected.

SBA loans. The U.S. Small Business Administration guarantees some loans made by traditional banks. The program may offer more competitive terms and longer repayment periods, but it can take several months for qualified applicants to complete the process and receive the funds.

Asset-based financing. Some specialty lenders extend loans that are backed by business assets such as securities, equipment, inventory, and accounts receivable. These loans are usually offered at higher interest rates but can sometimes be used to access capital quickly.

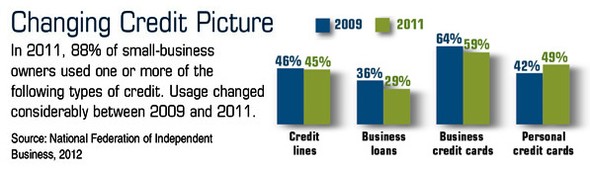

Credit cards. The financial protections that apply to personal accounts do not apply to business accounts, so credit-card companies could raise your rates without notice. Consequently, more people are using personal accounts for business purposes and/or paying off balances each month.3Using a business credit card responsibly, however, is one way that a newer business could help establish the positive credit history that it might need to obtain business loans in the future.

Many small businesses are coping with today’s challenging credit environment. If you are thinking about borrowing funds to strengthen or grow your business, be sure to weigh your options carefully.

1) National Federation of Independent Business, 2012

2) The Wall Street Journal, February 1, 2012

3) The Wall Street Journal, January 16, 2012

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. Copyright © 2012 Emerald Connect, Inc.