Taming Taxes

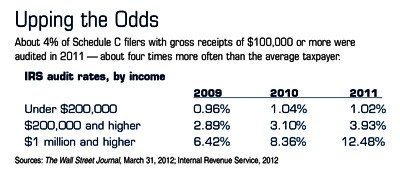

Small-business owners and independent contractors may be more likely than other taxpayers to benefit from the home-office tax deduction, which has an average value of more than $2,600.1 But some taxpayers may be hesitant to claim this potential tax benefit on their personal tax returns, fearing that it could trigger an IRS audit. Their worries are […]

read more »