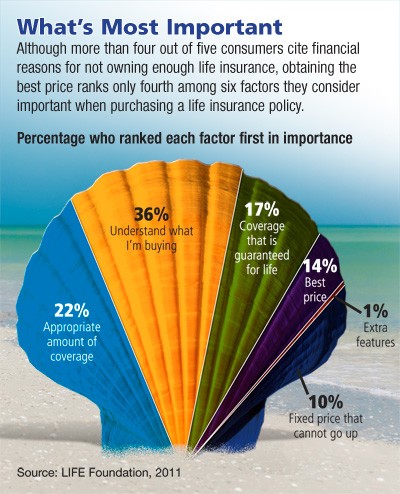

More Affordable Than You Might Think

In a 2012 study, more than 80% of respondents cited financial reasons for not having enough life insurance coverage to meet their needs, yet they overestimated the cost of life insurance by almost three times the actual price.1 Considering these perceptions, it may not be surprising that life insurance ownership is at an all-time low, with […]

read more »